We offer Anti-Money Laundering Solution (AML) for banking & financial services industry. Our Anti Money Laundering Solution empowers banks and financial institutes to proactively manage AML risks and compliance. The AML solution facilitates the analysis, categorization and assessment of money-laundering risks. This AML solution is an enterprise level monitoring and surveillance solution. With this solution, you can instantly access information for prevention measures and the monitoring system can automatically monitor relevant money-laundering suspicious customers and transaction data. The AML service offering can be leveraged to review and enhance existing AML solutions, as well as to suggest and implement new solutions, based on every customer's requirements.

Key Features

Fast Filing Regulatory Reporting: Expedite regulatory reporting with efficient filing processes.

Automation Process: Automate tasks and workflows to streamline operations.

Proactive Monitoring End-To-End Transaction: Monitor transactions comprehensively from start to finish for proactive risk management.

AML Search Engine: Utilize a powerful search engine for efficient anti-money laundering (AML) investigations.

Data Management: Manage data effectively with robust storage and organization capabilities.

Watch List Management: Seamlessly manage watch lists to ensure compliance with sanctions and regulatory requirements.

Benefits

Simplified and Seamless Integration: Effortlessly integrate the system into existing processes without disruption.

Robust Data Analysis: Utilize advanced analytics for thorough and accurate data interpretation.

Up-To-Date Customer Information: Access real-time customer data for informed decision-making.

Helps Meet Regulatory Requirements: Ensure compliance with evolving regulatory standards and guidelines.

Streamlines Compliance Operations: Simplify compliance procedures for increased efficiency.

Improves Risk Protection: Enhance risk management strategies to safeguard against threats.

User-Friendly System Reduces Manpower Costs: Reduce staffing needs and associated costs with an intuitive platform.

Seamless on-boarding

Tailored Screening Profiles: Avoid unnecessary screening by aligning screening profiles with your risk-based approach, ensuring quicker and easier onboarding for customers.

Automated Screening: Utilize an automated system for screening with enhanced accuracy, leading to significant cost reductions in compliance.

Document Scanning: Seamlessly scan personal user documents such as passports, ID cards, visas, and other required documents, ensuring compliance with legal requirements.

Document Authentication: Authenticate the validity of personal user documents to ensure the accuracy and reliability of the onboarding process.

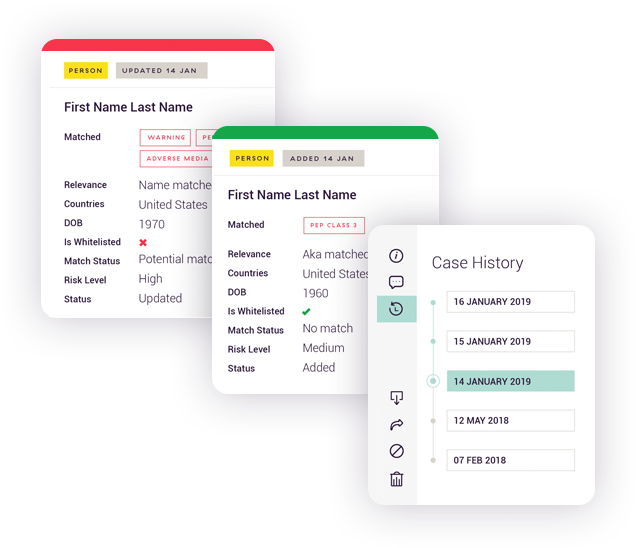

Automated, ongoing risk monitoring

Comprehensive Coverage:

- Stay ahead of evolving risks with our extensive coverage of Sanctions, PEPs (Politically Exposed Persons), and Adverse Media.

- Benefit from real-time identification of new risks, coupled with improved data quality and provenance.

Tailored Monitoring Criteria:

- Customize monitoring criteria to focus on risks relevant to your organization.

- Utilize clear case management tools to prioritize and review identified risks effectively.

AML Compliance and Protection:

- Safeguard your organization from potential prosecution with our robust anti-money laundering (AML) solution.

- Achieve peace of mind knowing that you are compliant with AML legislation through thorough due diligence measures.

Faster remediation, fewer alerts

Tailor monitoring criteria to only see what you want, showing new risks relevant to you, with clear case management to prioritize and review.

You can “whitelist” clients that don’t pose a risk, in turn reducing false positives at onboarding and ongoing monitoring.

AML solution is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing, such as securities fraud and market manipulation.

KYC and Monitoring

Digital Identity Verification: Determine the authenticity of individuals and detect synthetic identities. Verify if the personally identifiable information (PII) provided matches the individual. Assess the suitability of conducting business with the individual.

Staged KYC: Implement a risk-based approach to KYC, ensuring a balance between customer experience and necessary due diligence.

Global ID Verification: Conduct digital identity verification on a global scale, ensuring compliance across jurisdictions.

Risk Profiles: Establish risk profiles to customize KYC rules based on customer risk levels, product types, geographical regions, and other factors.

Sanctions

- Sanctions Lists Integration: Seamlessly integrated with multiple sanctions lists in various formats.

- Regular Updates: Ensures lists are frequently updated, either in real-time or at specified intervals.

- Applicability Configuration: Customize which lists are applicable to specific countries or transactions.

- Real-time and Batch Scan: Conducts real-time scans during KYC processes and batch scans for thorough screening.