ULIS Fintech Management stands as a pivotal force in driving financial performance for telecom operators, potentially accounting for as much as 2% of total revenue. In scenarios where traditional debt collection efforts fall short, operators seek to optimize debt recovery while minimizing costs and preserving brand reputation. Enter ULIS Fintech Grievance Management Software: a robust dispute management system designed to meticulously track and handle all forms of disputes, while also automating the management of customer bad debts.

Dispute Initiation: Utilizing alerts generated during Invoice Analysis, the system seamlessly initiates disputes. Additionally, our audit team has the authority to trigger disputes based on their own investigations.

Tracking: All disputes are meticulously logged as tickets within the system, allowing for efficient monitoring. These tickets can be customized to include reminders for timely follow-up actions.

Reporting: With intuitive dashboards, you gain insightful oversight into disputed and recovered amounts across various parameters such as service, vendor, or location, facilitating informed decision-making.

System Features

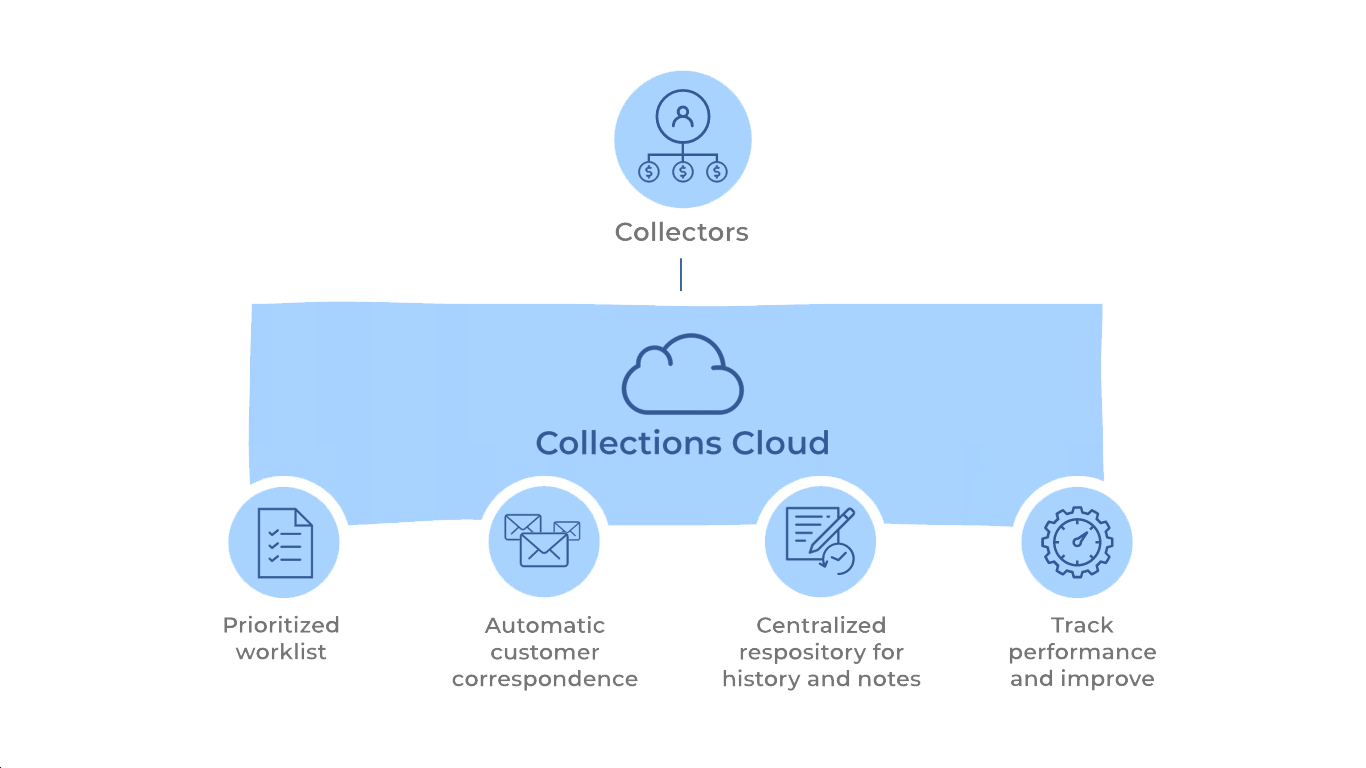

- Manage External Agencies, legal collection and enable new collection channels.

- Manage settlement negotiations and refining.

- Advance settlement options with the ability for installments.

- Quick to deploy and expand

- Detailed history logging and robust reporting

- Fully integrated and synchronized.

Unblock cash flows with fast and accurate decisions

Accelerate your cash flow recovery with precision using Dispute Manager. This cutting-edge solution empowers your team with comprehensive data and reporting on disputed transactions, facilitating quick identification and resolution of issues. Continuously refine your processes to streamline dispute handling, reducing both time and costs. Here's how Dispute Manager simplifies the process:

Continually improve processes to cut dispute time and cost

- Effortlessly initiate disputes for transactions.

- Seamlessly mark invoices and select reasons from a user-friendly dropdown menu.

- Enhance communication by adding notes or attaching relevant files.

- Stay informed with real-time notifications for every dispute.

- Centrally monitor and manage all disputes, easily updating statuses as resolutions occur.

- Access a detailed audit trail for complete transparency and accountability throughout the process.

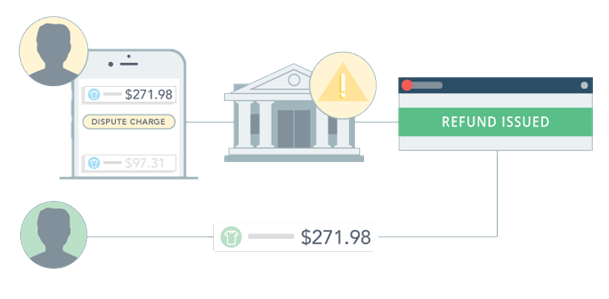

Real-Time Dispute Resolution (RTR):

- Enrolls merchants in Visa Merchant Purchase Inquiry (VMPI) for instant communication with Visa's dispute management platform, Visa Resolve Online (VROL).

- Facilitates real-time transmission of customer, order, and product details to preemptively address disputes.

- Automatically stops disputes before they escalate by proactively resolving issues.

Track and Analyze Automation Results:

- Utilizes DataFeed within the Grievance App to monitor and analyze automation outcomes.

- Identifies defective products and operational breakdowns promptly.

- Provides real-time overviews and allows for the export of detailed reports for in-depth analysis.

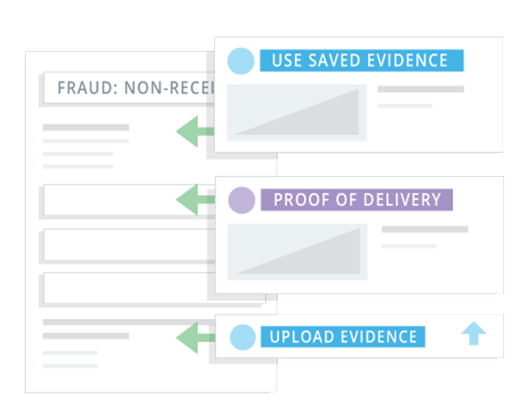

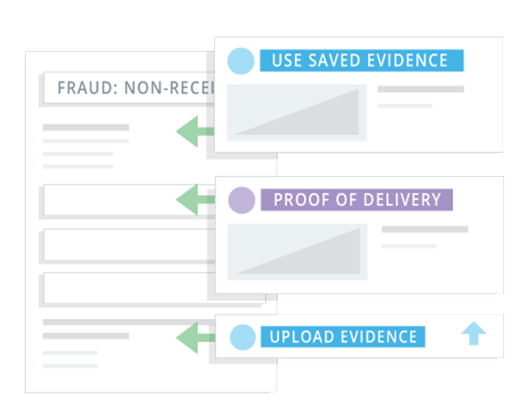

Automated Submission of Dispute Responses:

- Streamline the process by automatically submitting completed responses.

- Utilize automated uploads and API calls for seamless submission.

- Ensure timely delivery of response documents to your processor.

- Format responses correctly according to card brand guidelines.

- Eliminate cumbersome emails, complex uploads, and outdated faxing methods.

Auto-Generated Compelling Dispute Responses:

- Effortlessly craft compelling responses with programmed dispute logic.

- Automatically generate detailed responses for each unique dispute.

- Integrate compelling evidence from account integrations into a single, formatted document.

- Ensure responses meet all requirements for submission.