APPLE AMBITIONS TO EXPAND IN THE FINTECH SECTOR

Mar 02, 2022 - 5 MINS READ

Apple ambitions to expand in the Fintech sector

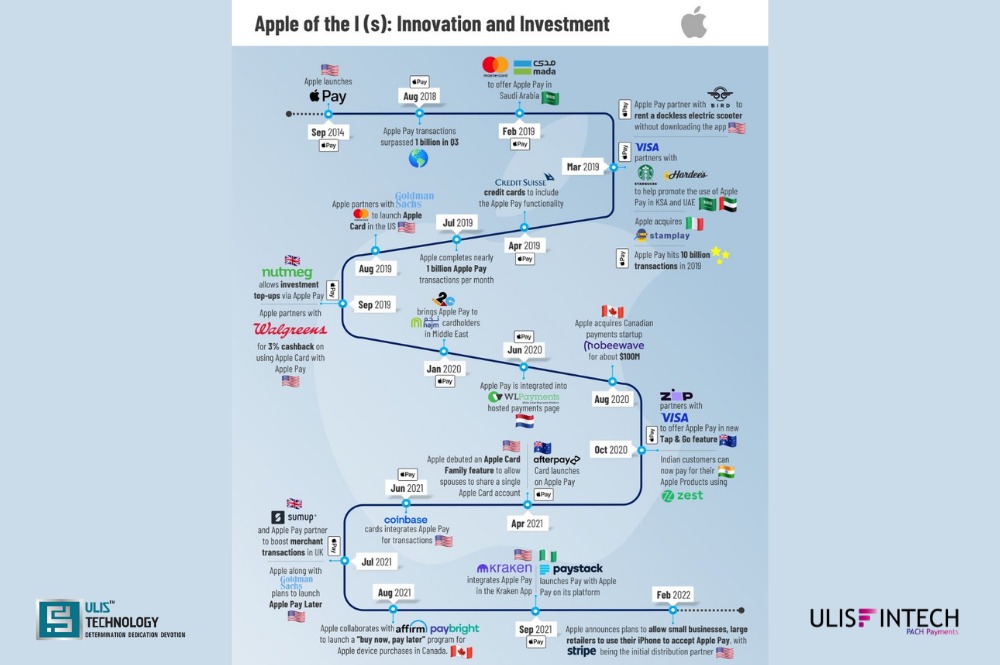

As several large internet businesses seek to expand and dominate the financial technology industry, Apple provides a few financial services. However, it's logical to suppose that Apple wants to go a step further and become a relevant participant in the financial industry, perhaps becoming your next bank. Here are five reasons why Apple might do so:

- Apple understands how to deliver a positive consumer experience

A typical issue about traditional banking systems is the absence of a user-friendly interface for viewing transactions and operations ranging from simple financial transfers to trading stocks. Apple excels at simplifying complex to the end-user. As a result, customers will interact with their banking platform through a clean interface that provides a snapshot of their financial situation achieved through the acquisition or collaboration of FinTech firms.

- Apple needs to come up with fresh strategies to sell iPhones.

Big tech businesses must continue to innovate over time. However, there is a limit to how much profit Apple can raise through new iPhone designs or the additional subscription services. The finance business would be a good idea to start if you want development and become a mega-tech firm. But the banking sector is interested in Apple for reasons other than its financial performance.

- Apple has a reputation and a dedicated customer base.

Apple has evolved into a new organ, a lifestyle brand. Adding more banking services to the iPhone is another method for Apple to become an ever more vital part of its customers' lives, increasing the barrier to switching hardware suppliers. Consumers trust Apple because of what the firm stands for and its reputation. They understand that Apple has a strong basis and will be there for them in the years.

- Data analytics and security.

Apple is the market leader in data management and handling. According to Ryan Gilbert, general partner at Propel Ventures, "money is essentially a kind of data, and Apple has been terrific at regulating data access." They'll approach money in the same way." Furthermore, Apple is well-known for its ability for consumers with enhanced security, which is critical for payments and banking. All new devices have biometric security, either "Touch ID" or "Face ID," given to the approved purchases via Apple Pay and Apple Card.

Analysis result

Like other large IT corporations, it will continue to add banking-related services to its existing products while avoiding full-stack banking. Businesses in these industries would be at risk due to the hassle of obtaining and maintaining a banking license. They will instead continue to work with licensed partners." this looks to be the most likely approach, at least for the foreseeable future. However, Apple's lack of a full-stack bank will not prevent it from disrupting the financial sector.