Impact of COVID-19 on Insurance Industry

Mar 02, 2022 - 5 MINS READ

IMPACT OF COVID 19 ON TWO BASIC INSURANCE

The COVID-19 epidemic influenced almost every aspect of global trade. The insurance industry was less immediately affected than other businesses. In the immediate aftermath of the COVID19 epidemic, the insurance business plummeted more rapidly than the market as a whole. However, in the second half of the year, the insurance business did not engage as in the rise. This essay focuses on the drivers in each insurance industry subcategories and how the COVID-19 epidemic will affect various sectors of the economy.

Insurance for Life and Health

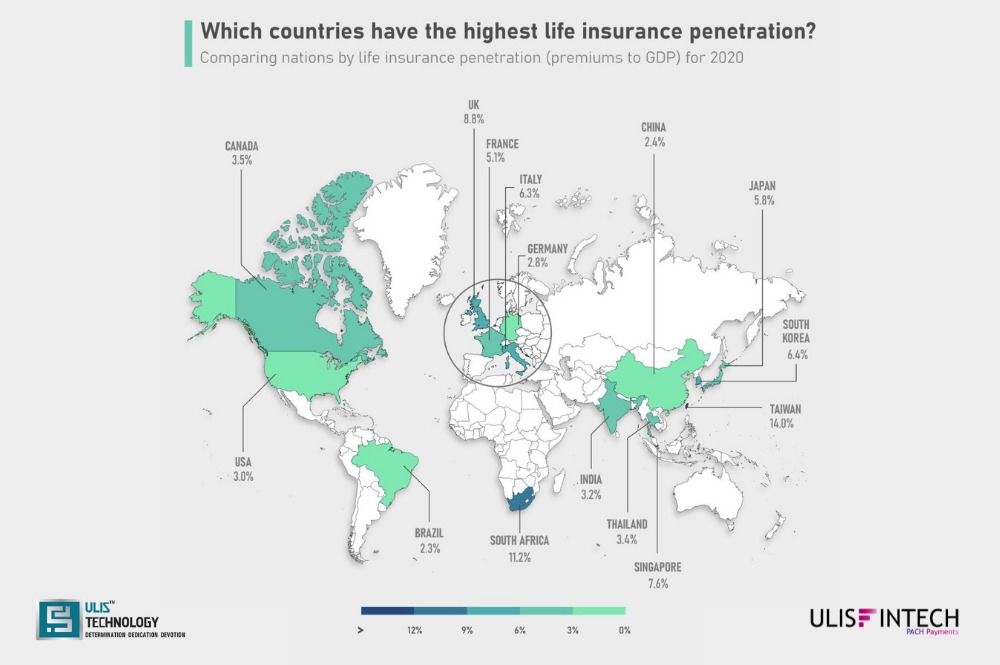

The penetration rate of life insurance in the United States has decreased dramatically over the previous decade, with the industry penetration rate has decreased to 2.9 percent in 2019 from 3.9 percent in 2008. Furthermore, the low-interest rates that have prevailed since the Economic Downturn have impeded portfolio returns. Another challenge this industry will face in the digital decade stems from an aging workforce.

In 2020, the sector services saw a significant drop in demand due to greater uncertainty in financial security, increased unemployment, and falling investment income. As a result, the average market capitalization of publicly listed life and health insurance firms in the United States fell by 13.4 percent, as seen in the graph below. Business value to earnings before interest, taxes, depreciation, and amortization (EBITDA) multiples fell in the first quarter of 2020 as the market responded to the economic consequences from the COVID-19 epidemic, but rebounded during the year.

Globally, the industry's primary growth drivers included premiums issued in developing nations, which contributed to 52.0 percent of the increase until 2019. However, developing markets accounted for 84.0 percent of the increase in the individual annuity market.

Insurance for Property and Casualty

North America accounts for 40.0 percent of the global property and casualty (P&C) market and has been particularly severely affected by pandemic and disaster-related losses.

4 P&C insurers' yearly operational return-on-equity fell from 8.3 percent to 2.8 percent in the first half of 2020. This loss is proven by $6.8 billion in losses experienced as a result of the COVID-19 epidemic, including workforce cutbacks that resulted in lower workers’ compensation insurance sales. Furthermore, because many small firms shuttered in 2020 as a result of pandemic-related downtimes, premiums sold to these enterprises may be hard to recover.

While 2020 was a difficult year for the P&C business, the results for the automotive insurance category were more varied. Due to changes in driving behavior and less demand for insurance, premiums were reduced in the vehicle industry, while insurers reported an increase in profits due to a reduction in accidents. As a result, the average market valuation of P&C businesses in the United States remained stagnant in 2020, with a significant decline in the first part of the year followed by sustained recovery. In the first quarter of 2020, enterprise value to EBITDA multiples initially increased as trailing EBITDA declined faster rate than enterprise value. However, enterprise value to EBITDA multiples subsequently steadied and have remained fairly stable throughout the years.

End Points

Overall, the COVID19 pandemic had a detrimental influence on the insurance business, locally in the United States and abroad. By the latter half of 2020, capitalizations declined. However, the insurance market recovered less than the markets.

Although most insurance sector categories recovered in the second half of 2020, experiencing financial were still lower on the year and witnessed less rebound than the industry as a whole, with EBITDA dropping throughout the year. As a result, enterprise value to EBITDA multiples grew in numerous areas during 2020. Looking ahead, industry income is likely to expand over the next five years as premium prices rise.