Journey of Amazon Payment Services

Feb 22, 2022 - 5 MINS READ

Encourage your business and its customer with Amazon Payment Services

One of the easiest and most profitable strategies for doing business or trading lies only on Amazon. With time, trading on Amazon has become very simple and taking the most of the business industry at the global level. The authorities of the company have offered many mediums which made traders easier to trade on this platform. Even the payment gateways of Amazon had become more porous and safer at the same time. However, in terms of insurance, payments, and checking accounts; Amazon is assaulting the finance industry from almost every angle.

With every passing year, it’s anticipating the banking strategy of implementing the financial services. Based on some reports, it’s very hard to assert that Amazon is developing the next generation bank. But still, it’s focusing more on developing its financial product for supporting its strategic goals. Therefore, the company has also built and launched various tools thatsupport the traders in making their business execute smoothly. The tool helps in increasing the number of the merchant on the platform and also assists in increasing their sale value. It also helps in reducing the buying and selling friction from both customer and merchant sides.

By side, Amazon has also invested some amount in the fintech industry as well. Therefore, here Amazon is concentrating more on international payments where the partners across the globe helped in serving Amazon's strategic goals. With Amazon's more involved in the finance industry, it’s not only building the traditional bank for traders. Instead, it focuses on building the modern banking experience and implementing the core components for making it suits Amazon's customers ( traders and customers).

In simpler words, the company is developing the bank that may be the more compelling development rather than just launching up the deposit holding bank. Moreover, since Amazon has started investing in its payment infrastructure and services overthe past few years, Amazon's e-commerce business has risen. And it has become more cash efficient for the company. Therefore, its digital payment gateway had been evolved as the digital wallet for the customers and payment network for the merchant in both online and brick-and-mortar systems.

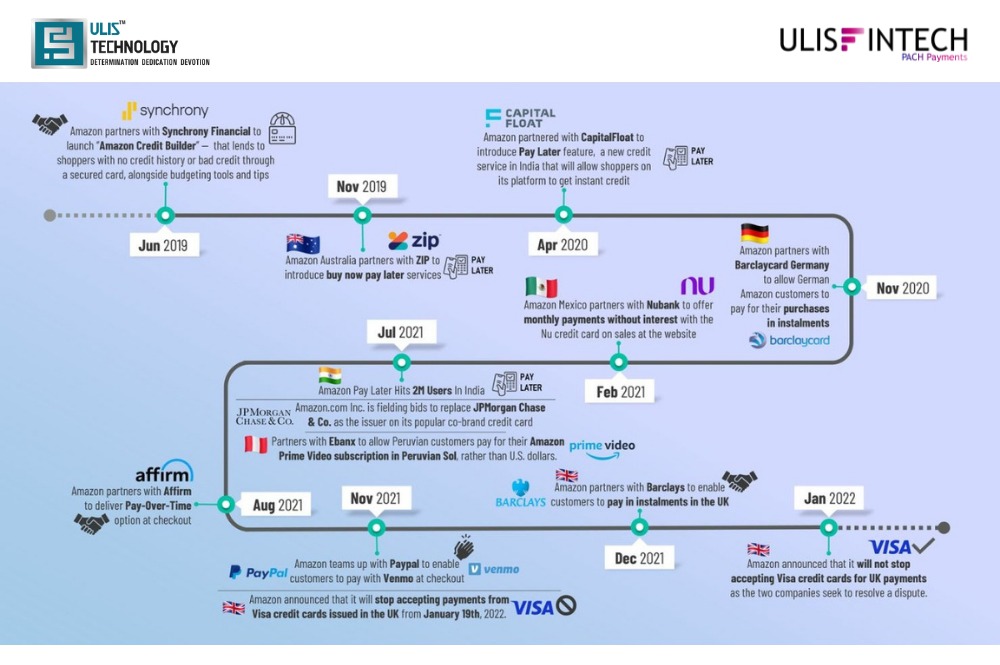

Meanwhile, from the year 2019 Amazon is continuously investing in its digital wallet, Amazon way and even establishing partnerships with traditional banks too. Irrespective of being the Amazon pay new in the global payment market, the company has experimented a lot with its payment module. Amazon has launched its digital payment gateway in 2007 along with the launch of TextPayMe was again launched in the year 2011 with the name Amazon Webpay. In 2014, it was shut down because it was unable to gain user interaction. After which it has come up with Venmo (now PayPal) which proves that the company was in hurry for launching the P2P payments.

In the year 2007, Amazon has also invested in the Fintech platform Bill Me Later which enables big retailers the ability to offer flexible finance options. It was further scooped up by PayPal and the company increased its focus on reducing payment frictionless options.