PROCESSING COST IS A CONSIDERATION TO ANALYZE WHEN SELECTING A PAYMENT GATEWAY

Mar 14, 2022 - 7 MINS READ

PROCESSING COST IS A CONSIDERATION TO ANALYZE WHEN SELECTING A PAYMENT GATEWAY

Choosing the correct payment processor for your company is one of the most essential decisions you will make when launching your e-commerce website. And after you're up and running, having the correct payment gateway for your business becomes even more important.

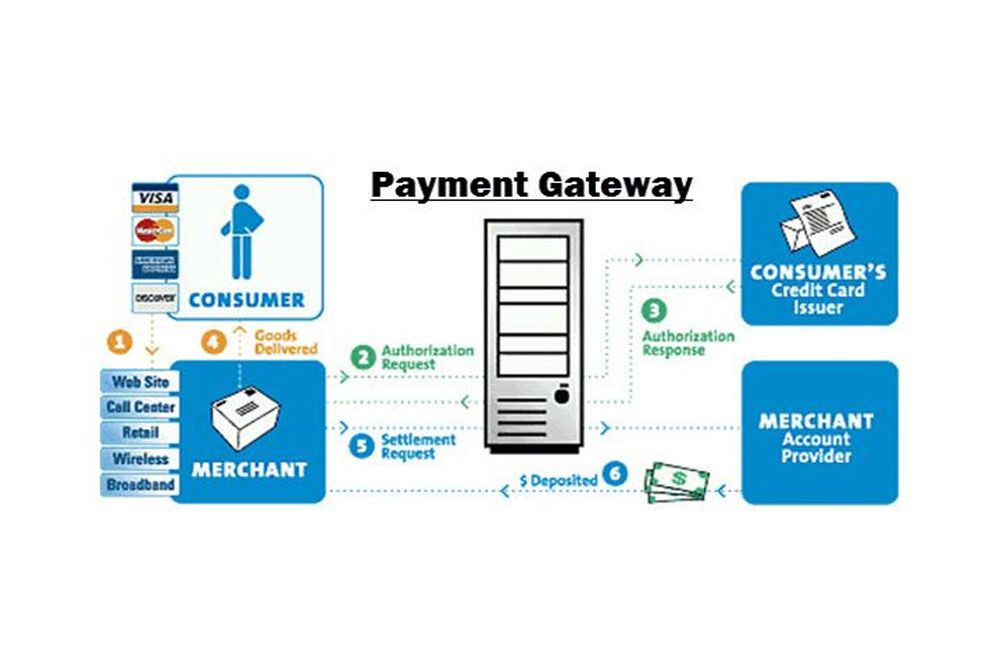

Components of online payment

When it refers to handling credit and debit card transactions, whether you trade online or in person, there are three major participants. You, the business owner, are at one end of the spectrum. Various technological methods link the two of you in the interim.

- You, the business owner: To take credit card payments, you must work with a merchant bank (also known as an acquirer) that accepts payments on your behalf and deposits them into a merchant account (which is not the same as a payment gateway) that they supply.

- Your client: A credit or debit card is required for your consumer to purchase and pay for their order. The issuing bank is the bank that authorizes your consumer for the card (and loans him or her the money to pay you).

- The technological framework: Two technologies in the middle allow you and your client to transact.

- This is a payment gateway, which is software that connects your shopping cart on your website to the card processing network.

- The second component is the payment processor (or merchant service), which does all of the hard lifting, such as routing the transaction via the processing network, issuing you a billing statement, coordinating with your bank, and so on. Often, your merchant bank is also your payment processor, which makes things easier.

Flow processing

As a business owner offline or E-commerce, it's important to understand how money flows from your consumer to you.

Payment processing is divided into two stages: authorization (approving the sale) and settlement (getting the money into your account).

This transaction takes place as follows:

- Your consumer uses a credit or debit card to purchase an item from your website.

- That information is routed through the payment gateway, which secures it before transferring it to the payment processor.

- The payment processor sends a request to the customer's issuing bank for funds to pay for your purchases.

- The issuer answers with a yes (permission) or no (rejection) (denial).

- If the transaction is authorized, the payment processor notifies you that it has been accepted and instructs your financial institution to credit your account.

This back-and-forth is completed in a few seconds.

The settlement is the second stage of the procedure (where you get paid!):

- The monies are sent from the card issuer to your financial institution, which deposits them into your account.

- The monies are readily available. Your bank may occasionally allow you to access your funds before they are remitted to them. They may also preserve a percentage of your account that you cannot access in case items are returned from clients later (this is known as a reserve in payments jargon).

This portion of the procedure might take a few business days.

Fees and Policies for Payment Processing

Now that you know how you acquire money from consumers via payment processing services, let's talk about the cost.

It's no surprise that everyone involved in the transaction, including the issuing bank, credit card organizations (Visa, MasterCard, etc.), merchant banks, and payment providers, wants to get reimbursed.

To put it simply, when you perform a transfer, you pay numerous fees:

- In exchange, the issuer receives a pre-agreed-upon portion of each sale. This cost is determined by a variety of criteria, including the industry, the value of the sale and the kind of card used. At the time of writing, there were distinct interchange fees.

- Analysis: The credit card affiliation (Visa, MasterCard, etc.) also charges an assessment, which is a pre-negotiated percentage cost.

- Markup: Your merchant bank gets a percentage cut by costing you a markup charge, which varies according to the industry, the value of the sale, and your monthly amortization volume.

- Processing: The payment processor (who may also be your merchant bank) earns money by collecting a flat charge every time you process a transaction, regardless of whether it's a sale, decline, or refund. It can also collect fees for account setup, monthly use, and even account termination.

Because the fees listed above are sometimes grouped together, it can be difficult to determine who is receiving what portion of your money.

Aside from the individual costs, processors can organize them in three ways as part of a comprehensive pricing plan:

- Horizontal pricing: You pay a predetermined percentage of total transaction volume, regardless of actual expenses. All of the costs listed above are included in one single charge.

- Pricing plus exchange: In addition to the interchange cost, your commerce service charges you a predetermined fee.

- Tiered pricing: The processor categorizes the 300 or so interchange rates into three groups, or pricing tiers: qualified, mid-qualified, and nonqualified. This makes it easier for you (and them) to comprehend. Whenever, because the CPU defines the buckets however it sees fit, it might be costly.

Merchant's Point of View

Naturally, every retailer will seek the processor with the most cost-effective pricing strategy. When calculating the processing cost, keep in mind that various transactions have varied costs. In general, certain transactions (as a group) will be less expensive to complete than others.

Viewpoint of a Reseller

Traditional forms of resellers (such as ISOs) are often interested in a price structure that is flexible and cheap. Software firms functioning as resellers may be interested in the processor's payment gateway's capacity to mix software and processing fees.

Conclusion

In general, "interchange plus" pricing is recommended for merchants that desire a clear and flexible strategy that takes into account card type variances. The advice is especially pertinent for people who like to use debit cards. A reseller should choose to collaborate with a processor payment gateway that offers a "cost-plus" price structure, as it makes pricing and reselling easier and appears to be more desirable in today's market.

Those resellers who want to charge their service charges as a component of the processing expenses should look at processors and payment gateways that can accommodate this.

Our next installment will focus on making it easier to integrate with various credit card processors and payment gateways.