PAYMENT GATEWAY AN IMPORTANT INTERCESSOR

Mar 03, 2022 - 8 MINS READ

PAYMENT GATEWAY – AN IMPORTANT INTERCESSOR

A payment gateway's purpose is to create a safe and seamless experience for your consumers, allowing them to complete transactions through various channels and with any common payment type. A high-quality payment gateway may help a business save money by eliminating the need for multiple providers and simplifying operations with top software integration and powerful reporting.

Payment gateways, whether virtual or physical, are utilized for the same transaction flow; however, digital capture files, rather than a credit card reader, are used to take credit card data for internet and mobile payments.

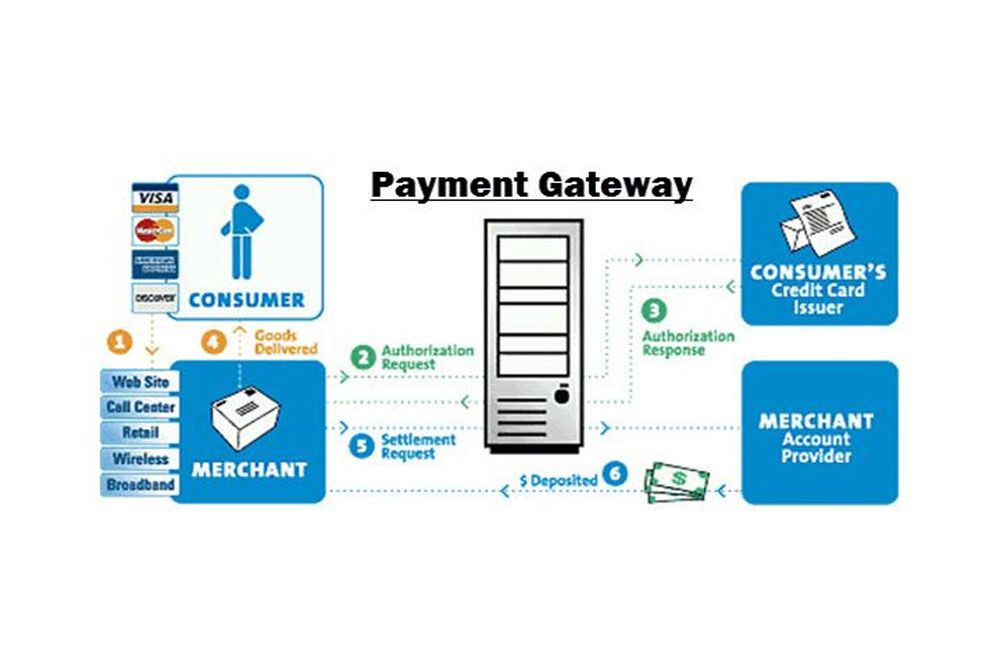

We've detailed how it works below:

- The customer uses the merchant's e-commerce site or credit card reader to make a credit card payment.

- The payment processor is:

- The transaction data is sent to the receiving bank (the acquirer or merchant bank)

- Identifies the credit card company that issued the customer's card (American Express, Discover, or MasterCard).

- The transaction data is sent to the appropriate payment switch.

- The payment switch transfers the transaction data to the appropriate credit card network after routing the request to the originating bank (the bank that issued the customer's credit card).

- The issuing bank employs fraud detection techniques to ensure the transaction's validity and that the consumer has sufficient credit in their account to make the purchase.

- The issuing bank either rejects or accepts the transaction and relays this information to the payment gateway and merchant bank via the credit card network.

It is analogous to a train traveling between stations, with the conductor conversing with the station master at each stop.

At the time of sale, credit card payments are validated by the issuing bank (through the payment gateway). Validated transactions are those in which the bank has set aside funds but the merchant has yet to be reimbursed. Clients' credit card statements will show this as a "pending" transaction.

After some time, generally at the end of the day, the merchant must balance payments, include gratuities if appropriate, and manually submit a batch capture, or "processing" file, for each pending credit card transaction. At this point, the pending transactions have been devoted, which means that the merchant now has the right to the cash withheld by the issuing bank. The payments is then forwarded to the trader's bank, where they may be retrieved immediately after being credited to the business account.

Payment Gateway Types

- Payment gateways that are hosted

In this type of gateway, the user is redirected away from your checkout page. Your consumer is sent to the Payment Service Provider (PSP) website when they click the gateway link. In hosted payment gateways, the client enters their payment information and is then led back to the merchant's website to complete the checkout process.

- Payment gateways that are self-hosted

Your customer's transaction information is gathered here on your website. After asking the information, the information gathered is sent to the payment gateway's URL. A number of gateways need payment information to be sent in a certain format, while others require a secret key or hash key.

- Payment gateways hosted by API

Customers must enter their debit or credit card information directly on the merchant's checkout page, and transactions are handled via an Application Programming Interface (API) or HTTPS inquiries.

- Integration of local banks

This gateway takes the consumer to the payment gateway's website (the bank's website), where they enter their payment and contact information. After completing the payment, the consumer is sent to the merchant's website, and the payment notification information is given.

Think about layering payment gateways.

The following are some of the numerous advantages this strategy may provide for your e-commerce platform:

- Easier process for your customer

Allow your consumers to choose what and when they want it. The utilization of a payment gateway that is MasterCard and Visa compliant will cover the majority of your activities. Offering your customers more credit card payment alternatives, on the other hand, will give them more convenience and lessen friction throughout the checkout process.

- Give everyone a backup plan.

Living without a credit card isn't as difficult as one might think. Your role as an e-commerce shop is to provide a variety of possibilities.